EPF tax relief limit revised to RM4000 per year. RM200000 RM200000 RM400000.

2021丽水学院录取分数线一览表 含2019 2020历年 大学生必备网

Monthly wages 750 By employer.

. Here is how it is calculated. For CPF members age 55 years old and above they get to earn 2 per annum on the first 30000 and 1 per annum on the next 30000 capped at 20000 for Ordinary Account. 12 Ref Contribution Rate Section A.

Kadar caruman bagi majikan dan pekerja terkini yang berkuat kuasa mulai gaji upah januari 2021 boleh. Given below is a list of interest rates of some of the previous years-. RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 8001 to 10000 1300 700 2000 From 10001 to 12000 1600 900 2500 From 12001 to 14000 1900 1000 2900 From 14001 to 16000 2100 1200 3300 From 16001 to 18000 2400 1300 3700.

Removed YA2017 tax comparison. Flexi has RM200000 and Wages RM200000. Wages up to RM30.

550 Considering the current EPF contribution rate to be 85 the monthly interest on EPF would be-Now assuming that the employee joined the organization on 1 April 2019 his contributions to his EPF account would be calculated from the financial year 2019 2020. EPF contributions tax relief up to RM4000 this is already taken into consideration by the salary calculator Life insurance premiums and takaful relief up to RM3000. 050 EPF Administrative charges AC 2 0.

RATE OF CONTRIBUTION FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM From 12001 to 14000 1900 1300 3200 From 14001 to 16000 2100 1500 3600 From 16001 to 18000 2400 1700 4100 From 18001 to 20000 2600 1800 4400 From 20001 to 22000 2900 2000 4900. 32500 Total EPF Contribution of Flexi is RM55000 Flexi has a salary of RM2000 per month and get a bonus of RM2000 how much does he has to contribute to EPF. This privilege is only for the first three years of employment.

What are the CPF contribution rates. Examples of Allowable Deduction are. 367 Employees Pension scheme AC 10 0.

However employees can make a lesser contribution of 10 if the organisation has less than 20 employees or for industries such as jute beedi brick coir and guar gum factories. EPF contribution April 2018 Rs 7835. When wages exceed RM70 but not RM100.

If a company is associated with beedi jute brick guar gum or coir industry. Total monthly contribution towards EPF Rs. When wages exceed RM30 but not RM50.

From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Contribution By Employer Only. EPF Account Balance Start of April 2018 Rs 0.

Employee EPF contribution has been adjusted to follow EPF Third Schedule. Employers contribution towards Employees Deposit-linked Insurance Scheme is. EPF Contribution Third Schedule.

The EPF receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non-pensionable public sectors as well as voluntary contributions by those in the informal sector. 001 or min Rs. Ref Contribution Rate Section E RM5000 and below.

65 Ref Contribution Rate Section C More than RM5000. And for the months where the wages exceed RM2000000 the contribution by the. Ii Employee should be a member of EPF Scheme 1952 Employees Pension Scheme 1995 whose contributions are received for any period during last six months September 2019 to February 2020 in the ECR filed by any eligible establishment against hisher UAN.

Introduced PCB Schedule Mode where PCB amount will match LHDN PCB Schedule. From RM248001 to 250000. The interest rate is decided after discussion between the Central Board of Trustees of EPFO and the Ministry of Finance at the end of every financial year.

Hendaklah dikira pada 11 daripada amaun upah bagi bulan itu dan kadar. Epf contribution table 2022 pdf - New SSS Contribution Table 2022. The epf said the latest contribution rates for employees and employers can be referred at the third schedule epf act 1991.

Every month the employee contributes 12 of salary basic salary dearness allowance towards the EPF account. The CPF contribution to each account varies according to the individuals age too. 500- EDLIS Administrative charges AC-22 0.

Employees age years Contribution rates from 1 January 2022. From 1980001 to 1990000 119400 109500 228900. When wages exceed RM50 but not RM70.

The EPF contribution rate for the financial year 2021 is 85. 065 From 01042017 Previous-085 from Jan 2015 or min Rs. So your and your employers EPF contributions started for the financial year 2018 2019 from the month of April.

According to the EPF contribution table. Table 1 CPF Contribution Rate Table from 1 January 2022 for Singapore Citizens or Singapore Permanent Residents 3rd year onwards Employees Age Years Employees total wages for the calendar month Total CPF contributions Employers Employees share Employees share of CPF contributions 55 below 50 Nil Nil. Jadual PCB 2020 PCB Table 2018.

Updated PCB calculator for YA2019. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. Employer contribution Employee provident fund AC 1 12.

Employer Contribution to EPF. Employee Contribution to EPF. Such contributions in ECR should have been received on monthly wage of less than.

Surah pertama diturunkan di gua hira. Employees Deposit linked insurance AC 21 0. The contribution can also vary in the case of women employees.

The following table summarises the current contribution rates for Singaporeans and SPRs from third year and onwards across the different age groups. The contribution rate of epf 11 percent epf socso way last content caruman kwsp 2019 schedule caruman kwsp 2020 11 peratus download timeline trãªs caruman. Employee shall be calculated at the rate of 55 of the amount of wages for the month.

SIP EIS Table. 13 Ref Contribution Rate Section A Applicable for ii and iii only Employees share. From 1990001 to 2000000 120000 110000 230000.

Bank Holidays In April 2020 Holidays In April Holiday Bank Holiday

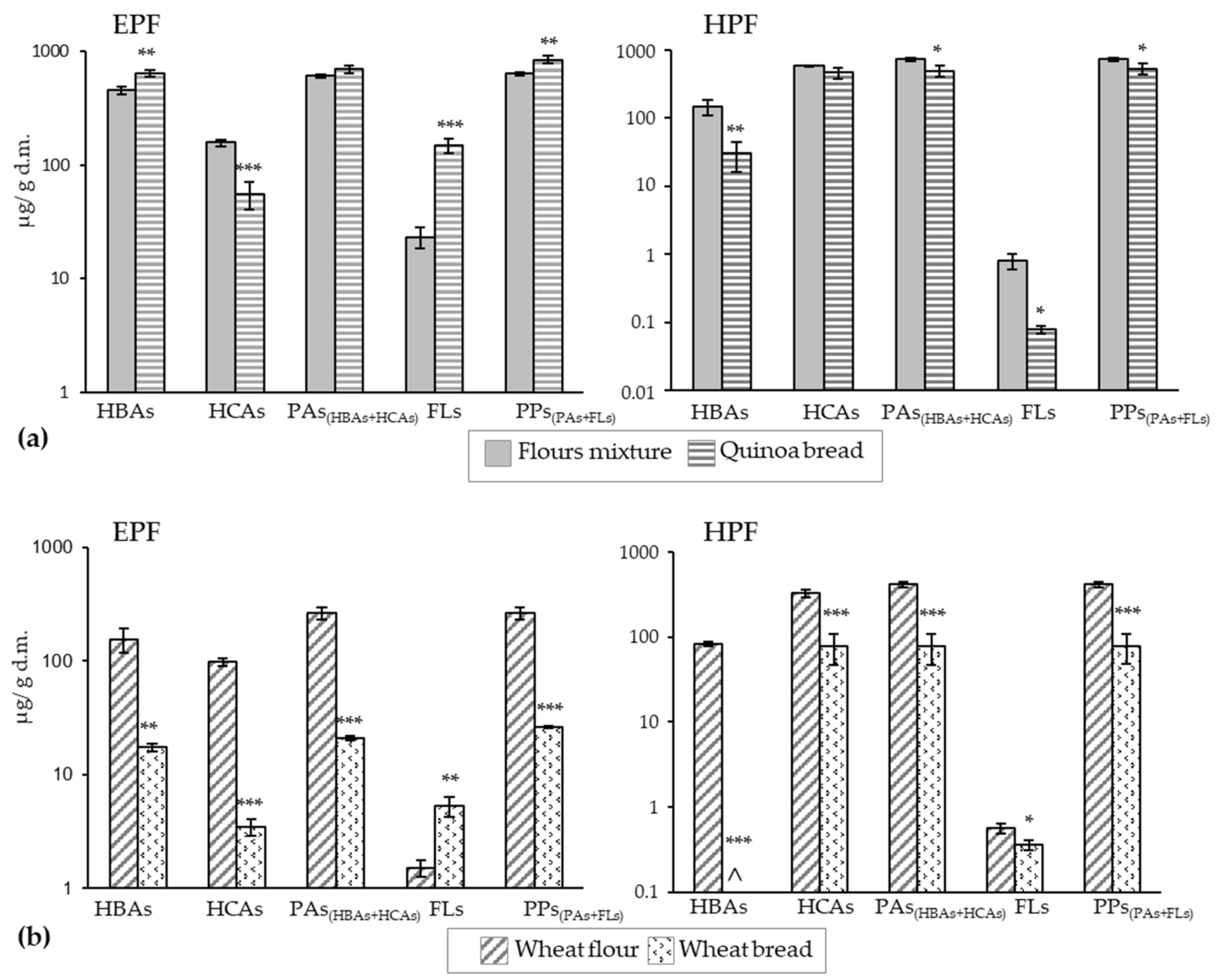

Antioxidants Free Full Text Changes In The Polyphenolic Profile And Antioxidant Activity Of Wheat Bread After Incorporating Quinoa Flour Html

Vpf How Long Is The Lock In Period Cann We Alter The Lock In Period Can We Stop The Contribution Whenever We Want Is It Taxable Can We Withdraw 100 Of The Vpf Contribution

Pdf Assessing The Adequacy Of Contribution Rates Towards Employees Provident Fund In Malaysia

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Epf Employees Provident Fund Interest Rate For 2018 19 Over 6 Crore Pf Members To Get This Interest Amount

Esic Reduced Contribution Rates From July 2019 Contribution New Employee July

8 Mac 2021 Commercial Marketing D I D

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Frontiers Aboveground Biomass Along An Elevation Gradient In An Evergreen Andean Amazonian Forest In Ecuador Forests And Global Change

Epf Contribution Table For Age Above 60 2019 Madalynngwf

Information On Maratorium Banks Website Bank Branch Knowledge

Epf Interest Rate 2022 23 Notification Calculate Latest News

30 Nov 2020 Bar Chart Chart 10 Things

Sukanya Samriddhi Yojana Calculator Calculator Investing Birth Certificate

Bank Holidays In April 2020 Holidays In April Holiday Bank Holiday

Epf Contribution Table For Age Above 60 2019 Madalynngwf